Here’s What you Need to Know About the Foreclosure Process and Foreclosure Timeline in Texas and How to Stop Foreclosure.

Let’s Face it – Foreclosure Just Sucks.

No one ever expects to be in this position, but bad things happen to good people. It’s normal during such a difficult time to feel confused, embarrassed, and even scared. You’re probably worried how a foreclosure will affect your credit and if you’ll be able to buy another house or even another car with a foreclosure on your credit report. You may even be wondering where you and your family are going to live. Or if you can even afford to move.

The uncertainties created by foreclosure are stressful, disheartening, and can be overwhelming. Sometimes the uncertainly that comes with not knowing what to expect can be worse than actually knowing what’s going to happen. That’s exactly why we put together this guide to help homeowners navigate the foreclosure process in Texas. The worst thing you can do is to ignore the problem and get caught by surprise when your house is sold at auction. By knowing what you’re up against, you can take steps to regain control of your life. The bottom line is that you don’t have to lose your house, so let’s take a deeper dive and see what options you have.

Can I Stop Foreclosure in Texas?

The simple and accurate answer is “yes.” Depending on your situation, there can be more than one way to stop foreclosure. Before we discuss the available options to prevent foreclosure, it helps to first understand how the state of Texas handles foreclosure and how much time you have to stop the process.

How Much Time Do I Have?

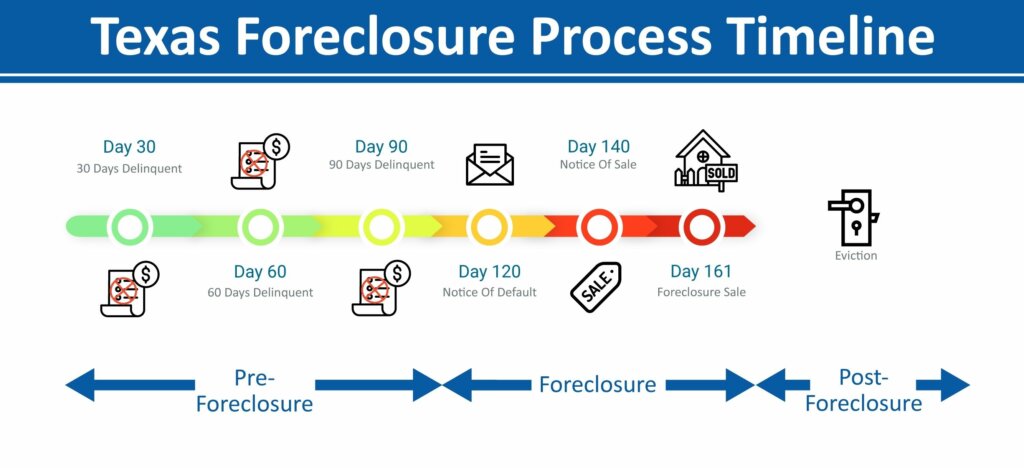

The good news is that, except in rare cases, most lenders can’t start the foreclosure process in Texas until at least 120 days after your first payment is missed. During that time, you can typically work with your lender to apply for various “loss mitigation” options to stop the foreclosure before it starts. We’ll cover your options for loss mitigation in the sections below.

The bad news is that once the foreclosure process is started, Texas has a rather quick foreclosure process. Because the foreclosure process in Texas is conducted by a trustee, it does not involve any filings in the courts, which means that the process moves quickly. That’s why it’s important to know your options and be equipped to make quick decisions. The entire foreclosure process can take as little as 41 days from the date the first notice is mailed, but typically takes a little longer depending on the timing of the mailing of the required notices and the actual foreclosure date.

So if you include the 120 day delinquent period and the 41 day foreclosure period, the Texas foreclosure process has approximately 161 days from the day that the first payment is missed until a home goes to auction. The timeline above is a summary illustration of the steps generally included in the Texas foreclosure process.

Knowing exactly where you stand can help you decide what might be the next best course of action. Let’s talk about the most common foreclosure avoidance options that are available for most homeowners.

Loan Modification

The first option for many homeowners is to ask the bank for a loan modification. A loan modification is a change to your loan terms. Often the modification involves extending the number of years you have to repay the loan, reducing your interest rate, and/or forbearing a portion your principal balance. Most banks do not want to foreclose and will be willing to work with you to modify your loan. If the bank accepts your application for a loan modification, they cannot foreclose while the application is pending. However, it’s important to carefully consider what kind of modification best fits your needs. If you receive a loan modification and you still can’t make the payments, your bank will be much less willing to work with you in the future and you may still be at risk for losing your house.

There are a couple of free resources available to help homeowners navigate the process of applying for a loan modification:

Dallas County Home Loan Counseling Center: The Dallas County Home Loan Counseling Center offers counseling and support for existing homeowners, including foreclosure counseling and credit counseling. Their counseling services for avoiding foreclosure include reviewing your mortgage loan, discussing your financial status, and helping you communicate with the bank. Counseling services are offered in English and Spanish and are free of charge.

CFPB: The Consumer Finance Protection Bureau is a government agency that makes sure banks and lenders are treating you fairly. If your home is about to be foreclosed on, you can call the CFPB at (855) 411-2372 and ask to be connected to a U.S. Department of Housing and Urban Development (HUD)-approved housing counselor. A HUD-approved housing counselor is specially trained and certified to help you assess your financial situation, evaluate options if you are having trouble making your payments, and make a plan to get you help with your mortgage. These counselors can work with you to see if there are any options still available for avoiding foreclosure, as well as to provide you with guidance on your next steps.

What if I Don’t Qualify for a Loan Modification?

The loan modification application must be submitted at least 37 days before a scheduled foreclosure sale, so it’s important to get started on the application process right away. If you don’t submit the application in time or are not able get approved for a loan modification, the lender can go ahead and file for foreclosure under state law. Fortunately, even if you’re not able to qualify for a loan modification, there are other options for stopping foreclosure. Before we discuss those options, it’s important to know a little more about the foreclosure process and timeline in Texas.

In Texas, the foreclosure process generally has three steps:

Step 1 – Notice of Default: Once a homeowner is 120 days delinquent on payments, the loan in considered to be in default. If a default occurs, the lender may initiate the foreclosure process. At this point, the lender is required to send a written notice giving you 20 days to bring your all of your payments current. The Notice of Default is a warning that the lender intends to accelerate the note and foreclose if the payments cannot be brought current in 20 days.

Step 2 – Notice of Sale: If the payments are not brought current within the 20 day period, the lender initiates the foreclosure process by instructing a trustee (designated by the lender) to sell the house. At this point, the lender is required to send a written notice of the pending foreclosure sale. This notice alerts the homeowner that the property will be sold on the first Tuesday of the month occurring at least 21 days after the notice was sent. Once the Notice of Sale has been posted, the foreclosure can still be stopped prior to the sale by paying the full amount due, which often includes late fees, penalties, and legal fees incurred as a result of the foreclosure process. These fees can add up to thousands of dollars, so it’s always best to stop the foreclosure before the 20 day Notice of Default period has passed.

Step 3 – Foreclosure Sale: Once a sale date has been set, the trustee posts a notice at the county courthouse and the foreclosure becomes part of the public record. Because the foreclosure becomes public at this point, anyone can see the details of the property that is being listed for sale, including the owner information. This is the point at which many homeowners get overwhelmed with letters and phone calls from attorneys, realtors, and investors who may offer various ways to stop or postpone the foreclosure sale.

If your home is sold at the Foreclosure Sale, it’s important to note that you do not have the right to redeem (buy back) your home from the new owner. If you are still living in the home after the Foreclosure Sale, the new owner will likely start the eviction process. In the eviction process, the county constable office will serve an eviction notice, which will include a court date. Following a court hearing, the judge will issue a notice to vacate (usually giving five days). If the house remains occupied after the five days, the county constables will forcibly remove the occupants and place all of the personal belonging outdoors. This is typically the worst-case scenario for someone who’s home has been foreclosed. We never want anyone to be put in this situation.

Being evicted from your own home would be a nightmare. It doesn’t have to get to that point. As long as you’re willing to take action before it’s too late, you shouldn’t have to worry about being evicted from your home. Let’s look at other ways to stop foreclosure once the process has been started.

Can I Stop Foreclosure Once the Process has Started?

Yes, once the foreclosure process is started, you still have time to stop it. That’s good news. Most homeowners facing foreclosure don’t know that there are options that can prevent having their home (and equity) taken by the bank. You don’t have to sit back and wait for your house to be taken from you. You have several options, even if the bank has started the foreclosure process. Let’s take a look at those options.

Reinstate the Mortgage: When a Notice of Default is sent, the notice will include a reinstatement amount, which is the full value of the missed payments along with any accumulated penalties or fees. If you can think of a way to quickly come up with some cash, you can avoid foreclosure by paying a lump sum to catch up on the reinstatement amount. Once the payments are caught up, the foreclosure will be stopped, the mortgage will be reinstated, and you can continue making your regular payments. This is typically the best-case scenario for avoiding foreclosure, but it’s not always an option for all homeowners.

Short Sale: If you think that you may owe more than your house is worth, you may be able to work with your lender to initiate a short sale. A short sale is a sale of your home for less than what you owe on your mortgage. If your lender or servicer agrees to a short sale, you may be able to sell your home to pay off your mortgage, even if the sales price turns out to be less than the balance remaining on your mortgage. A short sale is an alternative to foreclosure, but unfortunately, because it is a sale, you will still have to leave your home and relocate. Additionally, a short sale will be reported on your credit and can hurt your credit score because you’re settling your mortgage for less than you owe rather than repaying the full amount.

Deed-in-Lieu of Foreclosure: A deed-in-lieu of foreclosure is an arrangement where you voluntarily turn over ownership of your home to the bank in exchange for cancelling the debt. One advantage to a deed-in-lieu of foreclosure is that the process is usually done with less public visibility than a foreclosure, so it may allow the you to keep the situation more private and minimize any harassment or embarrassment. This option will stop foreclosure and relieve you of the debt, but unfortunately you will still have to leave your home and relocate.

File for Bankruptcy: Filing for bankruptcy may also be an option for stopping foreclosure. In fact, if a foreclosure sale is scheduled to occur in the next day or so, the best way to stop the sale immediately may be filing for bankruptcy. Once you file for bankruptcy, something called an “automatic stay” goes into effect. The automatic stay is an injunction, which stops the lender from foreclosing on your home or otherwise trying to collect the debt, at least temporarily. In many cases, filing for Chapter 7 bankruptcy can delay the foreclosure by a matter of months. Or, if you want to save your home, filing for Chapter 13 bankruptcy might be the answer. On additional thing to consider is that filing bankruptcy can have a severely negative impact on your credit score. A Chapter 7 bankruptcy will remain on your credit report for 10 years. A Chapter 13 bankruptcy will remain on your credit report for 7 years. To find out about the bankruptcy options available to you, speak with a local bankruptcy attorney. If you’ve already received a foreclosure notice from your lender, chances are you’ve had many attorneys try to contact you regarding using their services to file for bankruptcy and stop the foreclosure.

If none of options mentioned above are good fit for your situation, you also have the option of selling your house on your own terms, rather than having it forcibly sold at a foreclosure auction. Let’s look into some of the considerations around selling your house to prevent foreclosure.

Is Selling My House an Option?

Yes. In most cases, up until the day that home is sold at auction, you can rescue your home by selling before losing it in foreclosure. If the options listed above don’t feel like a good fit for your situation, or you decide that you want, or need, to sell your home to prevent foreclosure, selling your house may be an option. For many homeowners, selling the house can save a lot of financial and emotional distress compared to handing it over to the bank in foreclosure. Typically, there are two options for selling your house – listing with a realtor or selling directly to a professional home buyer.

Listing with a Realtor: Listing your house for sale with a realtor can be a good option if your house is “move-in ready” or if you’re at the beginning of the foreclosure process and not in danger of your house being sold at auction. If you’re considering working with a realtor to sell your house, make sure you are working with a realtor that is experienced in selling homes that are in pre-foreclosure or foreclosure. When listing with a realtor and selling to a traditional buyer, there is a real threat that the process of listing the house, finding a buyer, and closing the sale will take longer than needed to stop the foreclosure. Just because you have the house listed for sale or under contract, does not guarantee that the foreclosure process will be stopped. If you have any concerns about getting the house sold in time, selling directly to a home buyer may be another option.

Selling Directly to a Home Buyer: If you’re up against a deadline and listing your house with a realtor seems risky or if you have a house that need some repairs, selling directly to a professional home buyer may be another option for stopping foreclosure. Unlike traditional buyers, most home buyers pay cash for houses. Because they pay cash, they’re able to cut out all the middle men (real estate agents, inspectors, appraisers, banks, etc.) that usually make the process of selling a home so difficult. This can considerably shorten the amount of time that it takes to sell a house. Most professional home buyers can close the sale in a few days. Additionally, most home buyers are in the business of making updates and repairs to houses, so they will be willing to buy a home that needs some work.

What To Do Next

The bottom line is that you have options. You don’t have to lose your house. If you’ve read this far and you think that selling to a professional home buyer may be a good option, we’d like to have the opportunity to work with you. Many of the homeowners that we work with do not want to have their credit damaged by a bankruptcy or short sale. Or they’ve just realized that it’s time to move on and start over. In most cases, we can stop foreclosure, save your credit, and let you keep your hard-earned equity. If you are facing foreclosure or behind on payments, time is of the essence, so it’s important that you take action now.

If you contact us, we can usually make you a fair all-cash offer within 48 hours. If you accept our offer, the closing can be scheduled in as little as 1 week…or on your schedule. If you think selling may be your best option, just fill in the form below and leave us a way to contact you. We’ve helped many homeowners stop foreclosure in Texas and we understand the frustration of going through foreclosure. By selling your home, you can stop foreclosure before it’s too late, which will save your credit and allow you to turn your equity into cash. We’ll do our best to help you quickly and safely navigate your options during these challenging times.

You Don’t Have to Lose Your House!

Simply fill out the form below or give us a call at (972) 850-8655 for your FREE, no-pressure cash offer. It’s easy to get started and there’s absolutely no obligation to accept our offer.

If you just have questions about selling your home to a cash buyer and aren’t ready to talk to anyone yet, we understand that too. Feel free to Get To Know Us or learn more about How Our Process Works.

Disclosure: This content is for educational purposes only and should not be construed as legal advice. If you are seeking legal advice please consult with an attorney.